On the same topic:

When considering a donation, it's crucial to ensure that your generosity reaches the right hands. How do I know if a donation is legit? This question is vital to answer before you proceed with any charitable contribution. In this extensive guide, we will explore various methods to verify the legitimacy of a donation and avoid common pitfalls that could lead to charity scams.

Researching Charities Before Donating

Before you donate your hard-earned money, it's essential to conduct thorough research on the charity. Start by visiting their official website and looking for their mission statement, annual reports, and contact information. Legitimate charities are transparent about their goals and how they use donations.

Furthermore, check for any news articles or press releases about the charity. Positive coverage from reputable news outlets can be a good indicator of the charity's legitimacy. However, be cautious of newly formed organizations that lack a substantial track record.

Here are some additional steps you can take:

- Read reviews and testimonials from other donors and beneficiaries.

- Check if the charity is registered with relevant authorities like the IRS in the United States.

- Look for the charity’s financial statements. These should detail how funds are being spent.

By taking the time to research, you can feel more confident about the integrity of the charity you're considering.

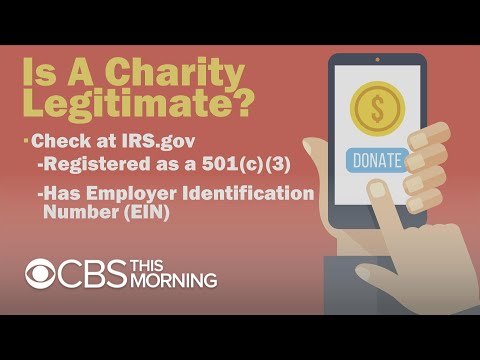

Verifying Charity Legitimacy

To further ensure you are dealing with a legitimate entity, request the charity's official documentation. This includes their tax-exempt status and registration number. In the U.S., you can use tools like the IRS's Tax Exempt Organization Search to verify if the charity is in good standing.

Another reliable resource is Charity Navigator, which provides a rating system for charities based on their financial health, accountability, and transparency. A high rating here can reassure you of the charity's credibility.

Unveiling the Truth: Is Car Donation Foundation Legitimate?

Unveiling the Truth: Is Car Donation Foundation Legitimate?Here’s a checklist for verifying a charity’s legitimacy:

- Confirm the charity’s 501(c)(3) status.

- Examine the charity’s impact reports and see how your donations will be used.

- Verify the authenticity of the charity’s contact information.

- Ask for endorsements or partnerships with well-known institutions.

By verifying these elements, you can protect yourself from scams and ensure your donation goes to a worthy cause.

Identifying Warning Signs of Charity Scams

Charity scams often use emotional appeals to get quick donations. Be wary of organizations that pressure you to donate immediately or use vague language about how your donations will be used.

Here are some red flags to watch out for:

- Organizations that don’t provide detailed information about their mission, costs, or how donations are used.

- Charities that ask for donations in cash, gift cards, or via wire transfers.

- High-pressure tactics or attempts to rush you into making a donation.

- Organizations with names that closely resemble those of well-known charities.

Always trust your instincts. If something feels off, take a step back and do more research.

Safe Donation Practices

When you're ready to donate, ensure that all transactions are secure. Preferably, use a credit card or a check for donations as these methods offer more security and can be traced and cancelled if necessary.

Here are some best practices for safe donations:

- Never share personal financial information over the phone or via email.

- Use secure websites for online donations. Look for URLs that start with "https" – the 's' stands for secure.

- Keep records of all donations for your personal records and tax purposes.

- Consider setting up a recurring donation to establish a long-term support with the charity, once you fully trust them.

Following these practices can help protect your financial information and ensure that your donation is used appropriately.

Tools for Checking Charity Credibility

Several online tools can help you verify the credibility of a charity. These include:

Legitimate Charity Alert: Veteran Car Donations Review & Guide

Legitimate Charity Alert: Veteran Car Donations Review & Guide- IRS Tax Exempt Organization Search: A tool to check the tax-exempt status of any organization.

- Charity Navigator: Provides detailed evaluations of charities based on their financial health, accountability, and transparency.

- GuideStar: Offers comprehensive information about each registered nonprofit’s mission, legitimacy, impact, reputation, finances, programs, transparency, governance, and so much more.

- BBB Wise Giving Alliance: Evaluates charities based on 20 rigorous standards of charity accountability.

Utilizing these tools can provide peace of mind that your donation is going to a reputable and effective organization.

Protecting Personal Information

When making a donation, it's crucial to protect your personal information. Avoid sharing personal details such as your social security number, bank account details, or other sensitive information.

Here are some tips to keep your information safe:

- Always initiate the donation yourself—don’t respond to unsolicited requests.

- Use secure and reputable payment methods.

- Be cautious of phishing scams that pretend to be a charity to collect your personal information.

By being cautious and vigilant, you can prevent identity theft and other frauds while still supporting worthy causes.

Dealing with Suspected Charity Scams

If you suspect that you have encountered a charity scam, it's important to act immediately to protect yourself and others. Report the scam to local authorities, and consider notifying organizations like the Federal Trade Commission (FTC) in the U.S.

Here’s what you can do:

- Report the scam to the FTC or your state’s charity regulator.

- Alert the actual charity if their name is being used fraudulently.

- Share your experience on social media to raise awareness among others.

Taking these steps can help stop the scammers from exploiting others and can assist in bringing them to justice.

Benefits of Donating to Registered 501(c)(3) Organizations

Donating to a registered 501(c)(3) organization not only ensures that your donation is going to a legitimate charity, but it also provides tax benefits. Contributions to 501(c)(3) organizations are typically tax-deductible, allowing you to reduce your taxable income.

Benefits include:

Uncover the Truth: Is Car Donation Wizard Legitimate?

Uncover the Truth: Is Car Donation Wizard Legitimate?- Ensuring that your donation supports legal and ethical causes.

- Possibility to deduct donations on your tax return, reducing your tax liability.

- Supporting organizations that comply with stringent governmental standards.

By choosing to donate to these organizations, you are contributing to transparency and accountability in the nonprofit sector.

Si quieres conocer otros artículos parecidos a How to Verify Legitimate Donations and Avoid Scams puedes visitar la categoría Community service.

Leave a Reply

You must be logged in to post a comment.

Related posts