On the same topic:

Legitimate Charity Alert: Veteran Car Donations Review & Guide

Legitimate Charity Alert: Veteran Car Donations Review & GuideWhen considering donating a vehicle to charity, many potential donors ask: Is the Car Donation Foundation legitimate? This question is crucial, given the rise of scams and the importance of ensuring that your donation actually benefits the intended cause. In this detailed exploration, we will delve into the operations, transparency, and impact of the Car Donation Foundation, particularly focusing on its program, Wheels For Wishes, and its support for Make-A-Wish chapters nationwide.

The Mission of Car Donation Foundation

The Car Donation Foundation operates under the banner of Wheels For Wishes, aiming to turn unwanted vehicles into wishes for children with life-threatening medical conditions. This noble mission not only supports a heartwarming cause but also offers an environmentally friendly solution to disposing of old vehicles. By donating a car, donors contribute to granting life-changing wishes for children, providing them joy and distraction during tough times in their medical journeys.

Empower Miramar: Donate Your Car to Make a Difference Today!

Empower Miramar: Donate Your Car to Make a Difference Today!

Legitimacy and Transparency of the Foundation

Assessing the legitimacy of a charitable organization is paramount. The Car Donation Foundation is a registered 501(c)(3) nonprofit organization, which ensures that it operates under strict regulatory standards for transparency and accountability. Financial reports and operational details are publicly accessible, providing clear insights into how donated funds are used. Prospective donors can review these documents to confirm that a significant portion of the proceeds goes directly to fulfilling the charitable mission.

Benefits of Donating Your Car to Charity

Donating your car to a charity like the Car Donation Foundation can yield multiple benefits:

Support Charitable Causes with Car Donations | Easy & Tax-Deductible

Support Charitable Causes with Car Donations | Easy & Tax-Deductible- Support for a Worthy Cause: Your donation directly supports the activities of Make-A-Wish chapters, helping to bring joy to children with critical illnesses.

- Environmental Benefits: Donating an old car reduces the environmental impact by recycling parts and materials and reducing the number of old, less efficient vehicles on the road.

- Tax Deductions: Donors can receive a tax deduction for their car donation, with the amount based on the vehicle's selling price or fair market value.

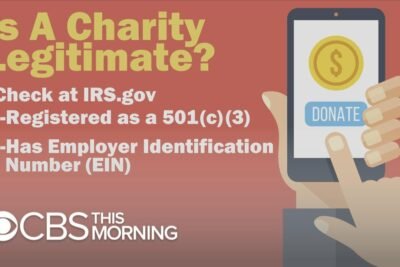

How to Ensure You Are Donating to a Legitimate Charity

To ensure that your car donation is going to a legitimate and effective charity, consider the following steps:

- Research the Charity: Verify the charity's 501(c)(3) status and look up reviews and ratings on platforms like Charity Navigator.

- Understand the Process: Reputable charities should provide clear information on how to donate your car and how the proceeds are used.

- Direct Donation: Ensure that you are donating directly to the charity or a verified agent, not through a third-party service that might keep a significant portion of the proceeds.

Maximizing Your Tax Deduction

When donating a car, it's important to understand how to maximize your tax deduction:

Charitable Showdown: Make-a-Wish Foundation vs Vehicles for Veterans

Charitable Showdown: Make-a-Wish Foundation vs Vehicles for Veterans- Itemize Deductions: To benefit from a tax deduction, you must itemize your deductions on your tax return.

- Fair Market Value: If the charity uses the car for its mission, you can deduct the full fair market value. Otherwise, the deduction is based on the sale price of the car.

- Documentation: Keep all documentation related to the donation, including the receipt from the charity and any correspondence.

The Car Donation Foundation, through its Wheels For Wishes program, offers a legitimate and impactful way to support children with critical illnesses while providing donors with a convenient way to dispose of unwanted vehicles. By following the guidelines for verifying the charity's legitimacy and ensuring proper documentation, donors can confidently contribute to a worthy cause and potentially benefit from a tax deduction. Always consult with a tax professional to understand fully the implications of your charitable donation.

Si quieres conocer otros artículos parecidos a Unveiling the Truth: Is Car Donation Foundation Legitimate? puedes visitar la categoría Community service.

Leave a Reply

You must be logged in to post a comment.

Related posts